Get Budget Friendly Car Loan Solutions for Your Personal Expenditures Today

Inexpensive finance services customized to fulfill individual requirements supply a method to address pressing costs successfully. By checking out the advantages of these services, individuals can discover a dependable companion in handling their monetary commitments.

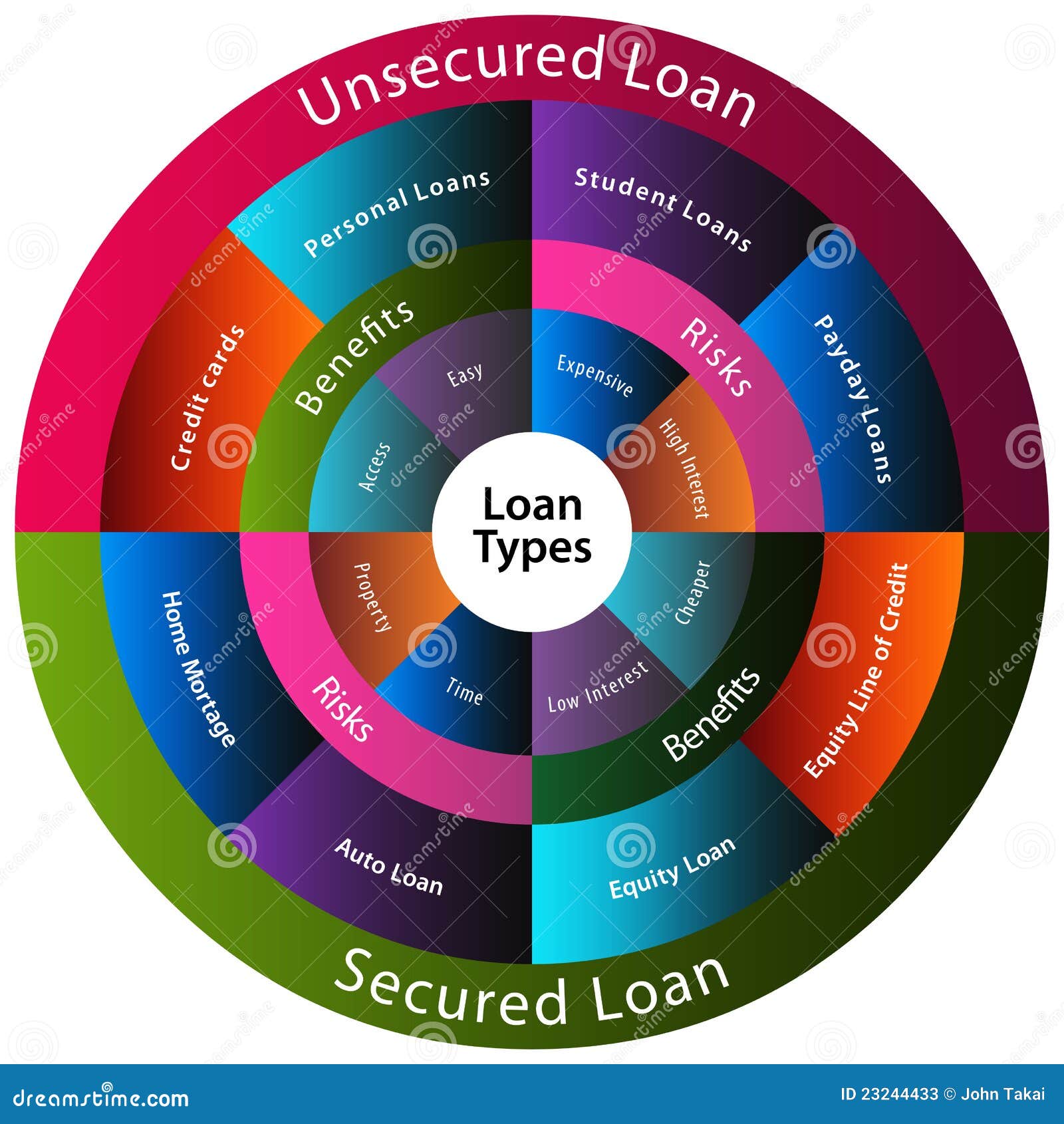

Benefits of Choosing Our Loan Solutions

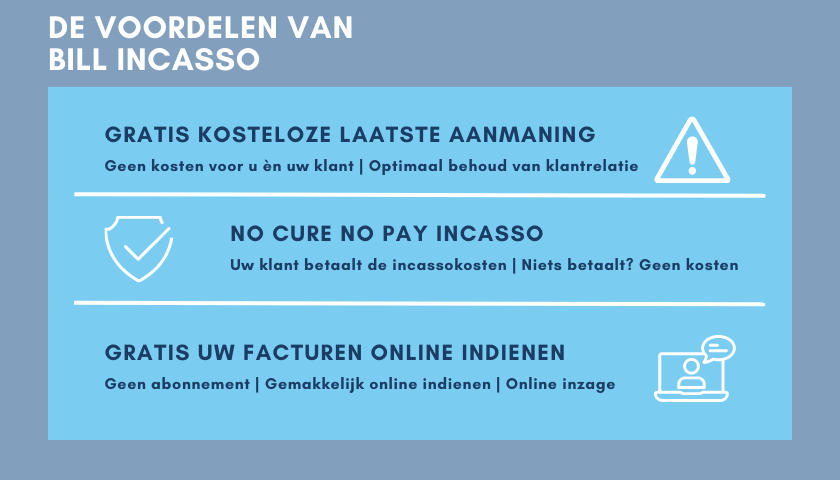

When considering alternatives for funding individual expenses, the benefits of choosing our lending solutions become obvious. Our lending solutions supply a range of benefits that deal with the diverse requirements of our clients. Our competitive rate of interest prices make certain that customers can access the funds they need without being strained by expensive prices. This affordability is matched by flexible payment terms, permitting people to manage their financial resources properly.

Furthermore, our funding application process is efficient and structured, supplying fast accessibility to funds when they are needed most. We understand that financial emergencies can occur suddenly, and our expedited authorization process ensures that our clients can resolve these situations immediately. Furthermore, our knowledgeable team is dedicated to supplying tailored aid to each consumer, guiding them through the loan process and resolving any kind of concerns or issues that may develop.

Straightforward Application Refine

Our structured funding application process is made to successfully satisfy the varied demands of our customers, ensuring a smooth experience from begin to complete. At our institution, we recognize the importance of simpleness and comfort when it comes to looking for a finance. To initiate the procedure, applicants can easily access our online system, where they will discover an user-friendly interface guiding them via each step. The application type is straightforward and just requests crucial details, making it quick to finish.

Once the application is submitted, our reliable system refines it quickly, permitting for quick approval decisions. Our dedication to a simple application procedure mirrors our dedication to offering available and easy finance solutions to meet the economic needs of our valued clients.

Competitive Rate Of Interest

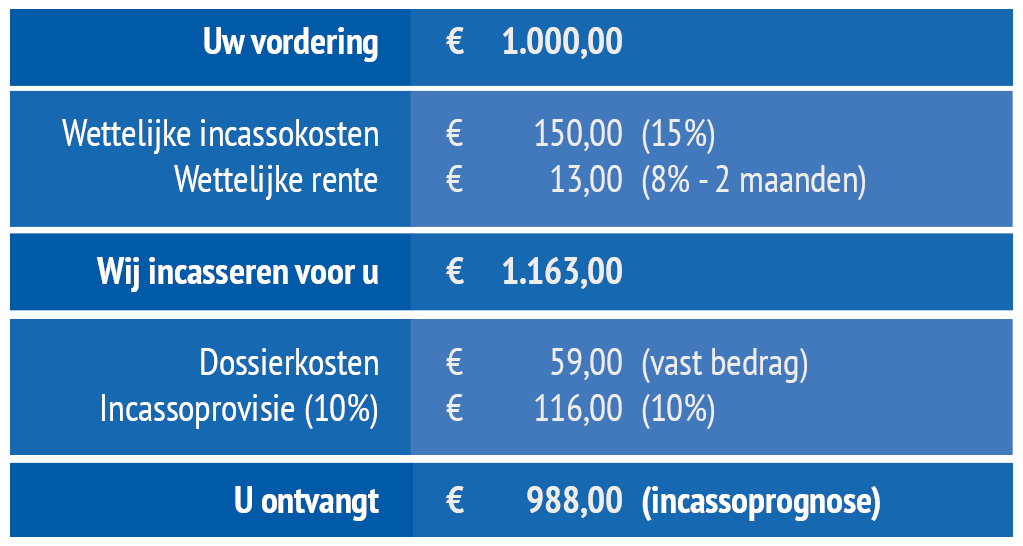

The organization offers affordable rates of interest that are made to offer value and cost to debtors seeking monetary support. By keeping the rate of interest rates affordable, consumers can profit from reduced total prices when repaying the car loan, making it a more economically feasible alternative compared to various other financing organizations. These prices are very carefully structured to strike an equilibrium in between being eye-catching to debtors and lasting for the institution, making certain a win-win scenario for both parties involved.

Competitive rate of interest mean that borrowers can access the funds they need without being strained by excessively high rate of interest fees. This can make a considerable difference in the total amount paid off over the life of the funding, inevitably conserving borrowers money in the future. Additionally, by using competitive prices, the institution intends to promote depend on and loyalty with its consumers, establishing long-lasting connections improved common advantage and financial well-being. Debtors can confidently rely upon these competitive interest prices to sustain their economic objectives and handle their individual expenses effectively.

Quick Approval and Disbursement

Reliable handling treatments make certain punctual authorization and dispensation of funds for borrowers looking for economic support. When looking for a funding to cover individual costs, quick approval and dispensation are critical variables to consider. Numerous lenders now supply streamlined online applications that permit customers to send their requests electronically, minimizing handling times substantially. These modern procedures commonly include automated confirmation systems that quickly assess a candidate's qualification, speeding up the approval process.

Upon authorization, funds can be paid out swiftly through digital transfers, making it possible for debtors to access the cash they need without unnecessary delays. Some banks also supply immediate authorization choices, even more expediting the dispensation of funds to accepted candidates. This swift turn-around time is specifically valuable for individuals encountering urgent unexpected expenditures or monetary circumstances.

Customized Repayment Options

Customized payment options can consist of differing the financing term size, changing the monthly installment quantities, or perhaps providing poise durations during challenging times. Consumers encountering short-term financial troubles may benefit from minimized payments till they stabilize their situation - personal loans canada. On the various other hand, those with varying revenues might go with settlement plans that make up these variations

Final Thought

To conclude, people seeking budget-friendly loan services for personal costs can profit from our streamlined application procedure, affordable rates of interest, quick approval, disbursement, and customized payment alternatives. Our solutions intend to give economic assistance without the concern of challenging treatments or secured loans canada high prices. Pick our financing solutions today for a smooth and cost-efficient loaning experience.

In addition, our experienced group is committed to giving tailored aid to each consumer, leading them via the finance procedure and attending to any type of questions or issues that may emerge. personal loans canada.

Our dedication to a straightforward application procedure reflects our dedication to giving obtainable and easy funding services to meet the economic requirements of our valued clients.

By keeping the passion rates competitive, consumers can benefit from lower total expenses when repaying the financing, making it a much more economically viable choice compared to various other loaning institutions. These customized payment strategies use flexibility, making it much easier for customers to handle their finance obligations according to their unique circumstances.In conclusion, people seeking affordable financing services for individual expenses can profit from our simplified application procedure, competitive passion rates, fast approval, dispensation, and customized settlement options.